- Bid/Ask

- Posts

- Enhanced Yield ETFs: Are 50% Yields Too Good to Be True?

Enhanced Yield ETFs: Are 50% Yields Too Good to Be True?

Do the High Returns Come With Hidden Risks?

Topics Covered in Today’s Research Note:

What is “Enhanced Yield”

How should it be used in your portfolio?

Zero Day Option ETFs - Reward or all Risk?

Enhanced Yield ETF Comp Sheets

What is Enhanced Yield

Enhanced yield is a class of ETF strategies that use options to generate even more yield than dividends or buybacks alone can provide.

Investor demand for yield has always been insatiable and when you couple this demand with recent weak bond market performance, investors near retirement and retail investors in general are looking for a bond alternative with the highest yield possible.

Enhanced yield comes in three flavors and generate very different results:

Stock ownership with call option selling on top

Synthetic index position with Zero-Day calls sold for yield

Selling of Zero-Day Puts for Yield and Return

Enhanced yield strategies track a stock index, making them more volatile than owning bonds, but the extra yield has more than made up for the volatility so far.

They come in many different flavors and in today’s note we are going to help you differentiate between the funds that are true bond alternatives and those that seem to be trading vehicles and not fit for buy and hold investors.

Who Are Enhanced Yield Funds For?

The largest misconception we want to clear up is that enhanced yield funds are definitely not replacements for your normal S&P index fund.

Enhanced yield funds are for investor’s who value cashflow.

These funds harvested the rising popularity and liquidity of the options market to create a bond-alternative, yield vehicle.

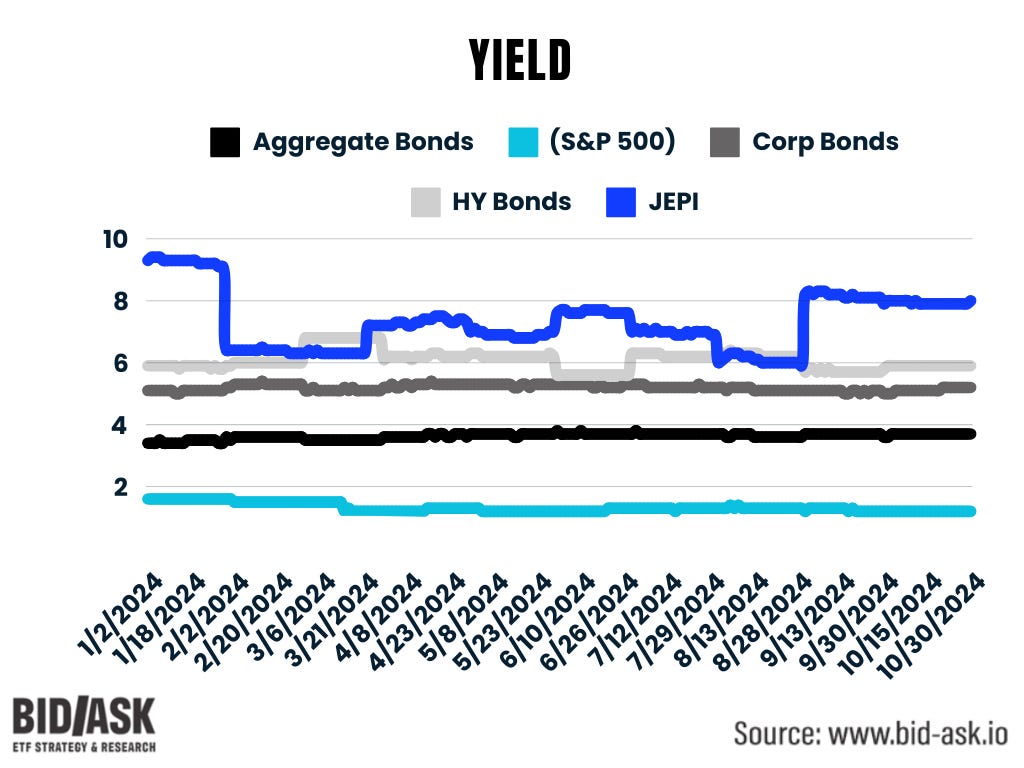

JEPI the largest and most well known enhanced yield ETF has an 8% current yield, materially higher than bond funds yielding 4%-6% depending on credit quality and maturity and far higher than the S&P 500’s 1.2% yield.

Current Yield

However enhanced yield funds like JEPI also have much higher volatility than owning bonds (though lower than the S&P 500 due to stock selection). JEPI is engineered for the stock portion to have a beta of 0.8x of the S&P 500 by buying the less volatile stocks in the index. Because of this JEPI and other enhanced yield funds have lower volatility and a higher yield than simply owning the S&P 500, the main reason they’ve become so popular with yield focused investors.

JEPI Volatility Currently 1.7x-2.0x Higher Than Bond Funds

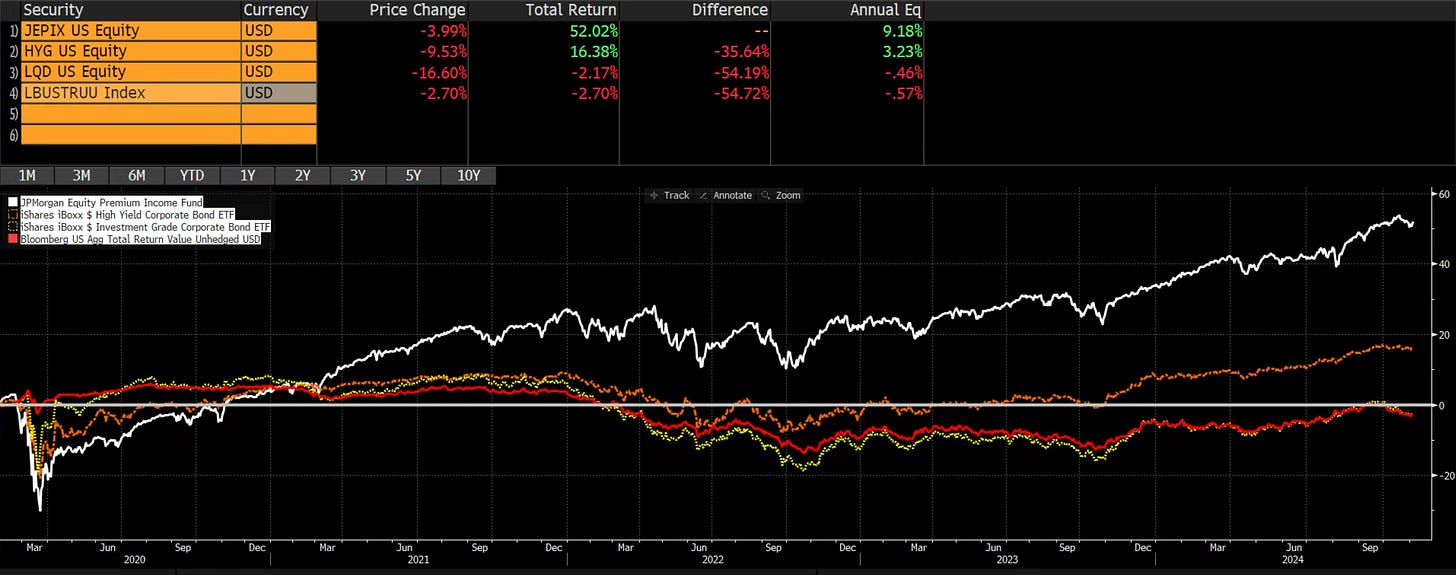

Even though JEPI is more volatile than bonds, it has performed surprisingly well over time vs bonds even in falling markets.

During the tech selloff of late 2021 and 2022, JEPI fell only 2% more than HYG on a price basis and outperformed high yield, investment grade and the aggregate bond index when including options income which is truly surprising.

If we zoom out even further to include JEPI’s total return since before COVID, the results speak for themselves. Even including the March 2020 selloff, when JEPI was down 20% more than corporate bonds, the ETF has outperformed investment and non-investment grade bonds substantially.

If the last five years are any guide, stock funds with an option overlay could replace bonds in an income focused investor’s portfolio.

Tax Considerations

From a tax perspective, how these funds choose to generate option income is very important.

In the case of JEPI, the funds decision to use equity-linked notes that provide exposure to calls means all the gains from these calls comes back to the investor as dividend income which is taxed at your personal tax rate.

If JEPI had chosen to sell calls directly, you would be getting capital gains and a return of capital which decreases your cost basis in the fund. Capital gains tax rates are favorable if you hold an investment long term as they are lower than personal tax rates so this vehicle is not the most tax efficient for high earners.

Zero Days Option ETFs - The Legacy of Meme Stock Mania

If Enhanced Yield ETFs are bonds on a sugar high, zero day options ETFs are bonds on steroids.

To understand how zero day options vehicles even exist we need to travel back in time to 2021…

Do you remember where you were when GameStop kicked off the meme stock mania?

Stocks moving 400% in a week on no news. Big operating losses were prized, not avoided, and message boards were humming with conspiracy theories about Citadel, the SEC and the entire plumbing of the financial system.

Most importantly, retail investors stuck at home with nothing else to do began to gamble on stocks en masse. For them, buying stocks wasn’t enough, they needed even more upside potential, even though it came with huge risks. Zero day options scratched the itch.

Zero day options, options with less than 8 hours to maturity, exploded in trading volume and now represent 22% of all option volumes according to the Options Price Reporting Authority, up from single digits prior to the pandemic.

Though much of the investor behavior from the 2021 period of irrational exuberance is behind us, the legacy of 2021 lives on with zero day options and the new ETFs that use them.

How Zero Day ETFs Work

Zero day ETFs are set up two different ways:

In the money options on the underlying index with income generated through selling covered 0-day calls.

Daily sale of in-the-money or at-the-money 0-day puts on the index.

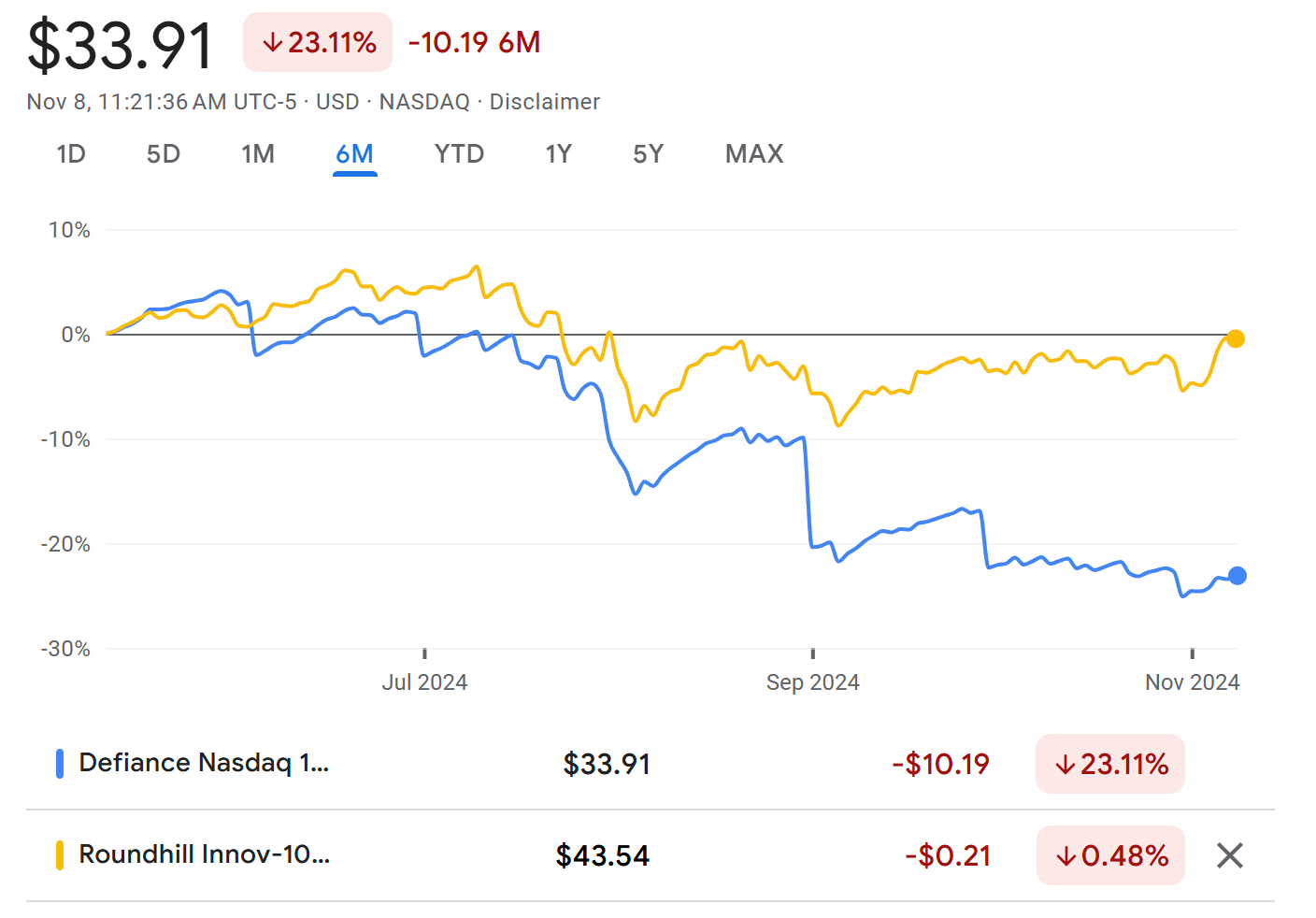

With both strategies you have capped upside and uncapped downside to the index, but strategy 1 has proven to be superior due to the fact it uses longer maturity calls and targets a certain options volatility while strategy 2 targets a specific daily return.

Strategy 2 resets daily, leading to much different performance over time compared to the index it tracks. The net asset value of the fund naturally has been falling over time and the higher yield vs strategy 1 hasn’t made up for the falling price.

Strategy 2 (Blue) vs Strategy 1 (Yellow) Price Return Over the Last 6 Months

50% Yield! But Whats the Catch?

Zero day option ETFs have been a grand slam for issuers are the most popular new ETF product of 2023-2024, besides Bitcoin ETFs. Its not hard to see why retail investors love the products. ETFs like RDTE (Roundhill Russell-2000 Zero Day Option ETF) and QQQY (Defiance Nasdaq-100 0-Day Income ETF) pay out weekly at a stunning 30%-50% annual rate.

But investors don’t seem to realize they are taking on not-insignificant principal risk in return for the double digit yield.

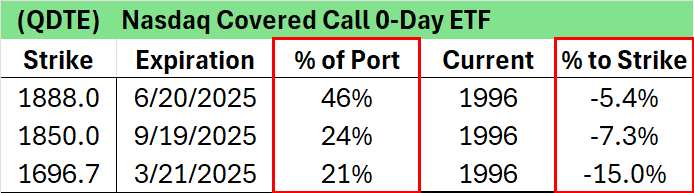

Take QDTE for example. Part of the strategy is to buy deep in the money call options with 3-12 months to maturity. Where the risk comes in is if the underlying index declines enough so that the calls go from IN, to OUT of the money at expiration. If that happens the call expires worthless. Investors in QDTE will lose the % of the ETF invested in that option.

To judge the risk of principal loss in QDTE we analyzed how far out of the money the call options were and the historic probability that the Nasdaq (The reference index) will fall enough to trigger a principal loss.

QDTE owns three different index call options, 6%-17% in the money. The most important option for this analysis is the one expiring next June with 46% of the entire ETF in it.

If the reference index declines more than 5.4% from now until June 20th, 2025, 46% of the portfolio goes to 0.

QDTE Options Analysis (November 6th)

Looking at the history of the Nasdaq, the probability this happens isn’t as small as we initially thought. Since the inception of the Nasdaq, it has been down greater than 5.4% a full 14.5% of the time, 1,416 days out of 9,766 trading days total since inception.

Put another way - there is a high probability that this options strategy will sustain losses at least once every seven years.

Even if we look at the probability of an annual 15% decline, it still happens 3.9% of the time, a tail risk to watch closely.

Rolling 1 Year Loss for the Nasdaq Since Inception

Declines since 2019 have been more muted for all indexes, but what is clear is you are taking on the risk of permanent capital loss in return for a very high weekly payout with the Roundhill family of zero day option ETFs.

Rolling 12 Month Loss Probability By Index

Below we’ve provided a summary of options holdings of all three funds so you can see the percentage of the portfolio in each strike and how far the index would have to fall on a trailing year basis to trigger a loss on the position.

Final Thoughts on Zero Day Options

Zero day options are a novel, but untested ETF product. The 25%-50% yields, paid weekly are a siren song to investors who have now poured over $1.2Bn into these products.

However, each fund comes with its own risks. The Defiance family of ETF’s resets daily leading to much different performance than the underlying index over time and the yield has failed to make up for the relative price underperformance over time. The Roundhill family of ETFs buys call options to simulate a long position in the index which introduces investors to the risk, however remote, the options will expire worthless. This potential loss of principal could offset much of the yield advantage vs the index.

Enhanced Yield Comp Sheets (As of November 13th)

Below is a comp sheet for the largest enhanced yield ETFs so you can compare costs, the index they use to generate income and most importantly the total return split between options income and price appreciation.

Below are the key attributes related to the largest zero-day option ETFs on the market. As you can see some of them, like QQQY, have consistent price declines which are offset by option income to some extent. As we discussed above, these products have specific risks related to the options sleeve that aren’t present in the other enhanced yield ETFs that simply use covered calls.

NOTE: The three Roundhill products launched March 7th of 2024 so the performance is only for 251 days of 317 total in the year so far.

Coming up Next: Reader’s Choice

What sector of the ETF market would you like us to cover next? Reply with your recommendations and we will pick the most popular sector or theme to cover next.

If you haven’t subscribed yet make sure to Join Bid/Ask for an ETF Edge…