- Bid/Ask

- Posts

- Do Tech ETFs Have an AI Problem?

Do Tech ETFs Have an AI Problem?

Exposing the Missing AI Exposure

Episode 1 of bid/ask was all about the structural failure of technology ETFs as market concentration increases.

Though the focus of that episode was on technology, not AI in particular, over the course of our research we noticed something strange.

All but one of the funds had one thing in common. They didn’t own Meta, Alphabet or Tesla.

and this got us thinking…

Do technology ETF’s have an AI weighting problem?

When three out of the four biggest technology ETF’s, managing over $150 billion for investors, don’t hold owners of some of the largest AI trainer clusters in the world, we start asking questions.

Now in all fairness to these funds they’re simply following their mandate. To track companies classified by the index provider in the “information technology sector”.

According to MSCI, Alphabet and Meta are in communication services while Tesla is in consumer discretionary.

But stepping back beyond financial industry grouping conventions, what should really be considered technology?

According to the dictionary:

Technology is a manner of accomplishing a task especially using technical processes, methods, or knowledge

We would argue computer software and hardware fall firmly under this definition and all three companies have those in abundance.

Meta recently purchased 350k Nvidia GPU’s all for AI workloads and is installing another cluster of 100k chips by November, making it a top 10 owner of AI hardware.

Tesla owns 10k Nvidia GPUs and is tooling up another 50k more to train self driving AI. Considering Tesla’s FSD software adds $10,000 of revenue onto a $30,000 car, and much more if you consider the much higher software margin that goes with the FSD sale, its hard to argue AI isn’t critical to Tesla’s future growth.

And last but not least, Alphabet. A pioneer in AI currently waiting for delivery of tens of billions of Nvidia’s cutting edge Blackwell GPU chips as we speak while also continuing to build its own in house AI silicon.

All three companies are obviously big players in AI and the success of AI products will drive a larger and larger portion of revenue growth in the future. Yet because of wonky classification scheme’s at most index providers, they are excluded from the largest technology funds available to investors.

Bottom Line: The MSCI GICS weighting scheme, used by most investors, is rarely flexible enough to recognize changing business models over time.

Improving Tech ETF’s with More AI?

In this episode we wanted to answer the question: “If Meta, Tesla and Alphabet were in the S&P 500 Technology Index before the launch of ChatGPT, would it have improved historical outcomes for investors in technology funds like XLK, FTEC and VGT?”

Before we get to the results, its critical to understand the regulatory constraints these funds all must follow.

The history of SEC diversification requirements

In 1940 congress passed the investment company act of 1940 to protect investors after the brutal 1929 stock market crash and great depression of the prior decade.

The most important section of the act requires almost all public companies (RICS), including ETFs, to meet two diversification requirements:

No position exceeds 25% of the portfolio

All positions greater than 5% can’t add up to more than 50% of the portfolio

No public ETF or fund can get around these rules if they want to market to the general public.

These diversification rules are wreaking havoc with many ETF’s. The market is growing more concentrated and these funds are being forced to sell down the MAG 7 stocks, some of the best performing lately.

Keep this rule in mind when picking ETF’s as it matters more than ever…

Results of The Bid/Ask Portfolio Backtest

Did adding Meta, Alphabet and Tesla to the S&P technology index provide a superior outcome for investors?

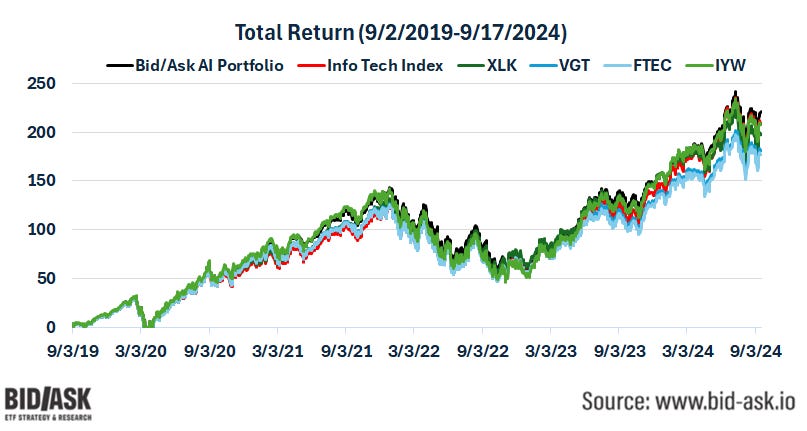

To test, we went back five years and created a customized S&P technology portfolio with Meta, Alphabet and Tesla added at their corresponding mkt cap weights at the time.

We then ran the portfolio forward letting market caps run unconstrained similar to the Index.

From a performance point of view, the Bid/Ask AI portfolio was an improvement over the index, beating it by 12% over 5 years.

A Look at Risk

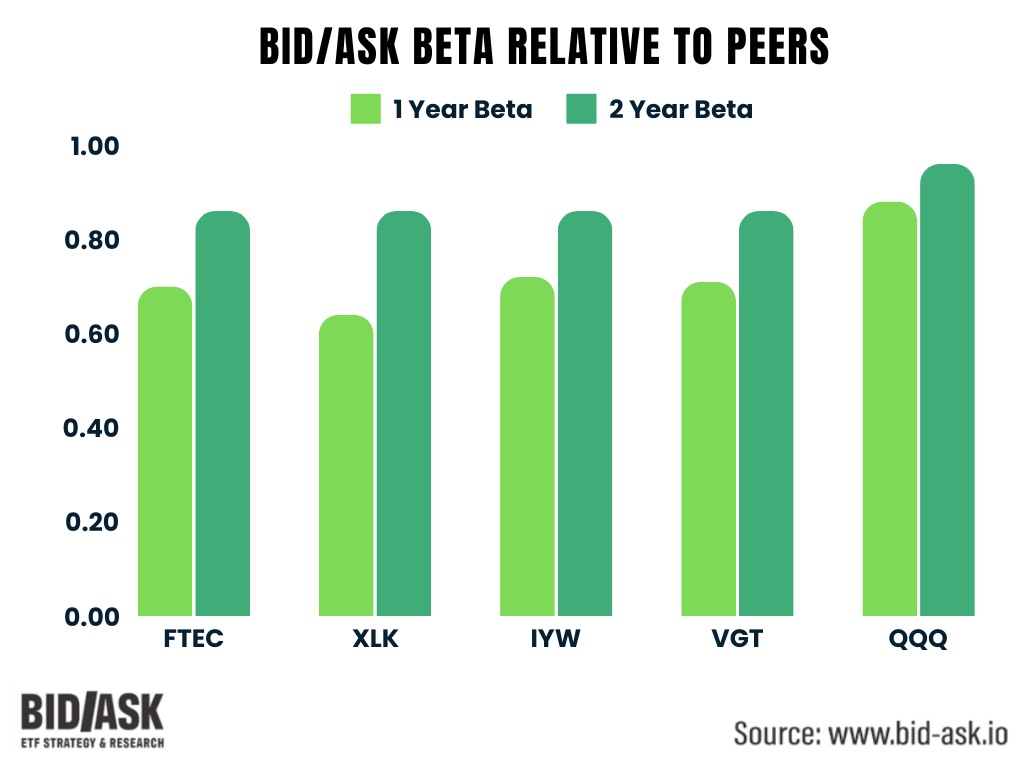

We also looked at the beta of the Bid/Ask AI portfolio vs the ETFs to see if adding Meta, Alphabet and Tesla also lowered volatility.

The answer was yes.

The Bid/Ask portfolio had a relative beta of between 0.64-0.71 vs the tech ETF’s.

Adding large caps like Meta, Alphabet and even Tesla seemed to improve both absolute and risk adjusted returns of a technology portfolio.

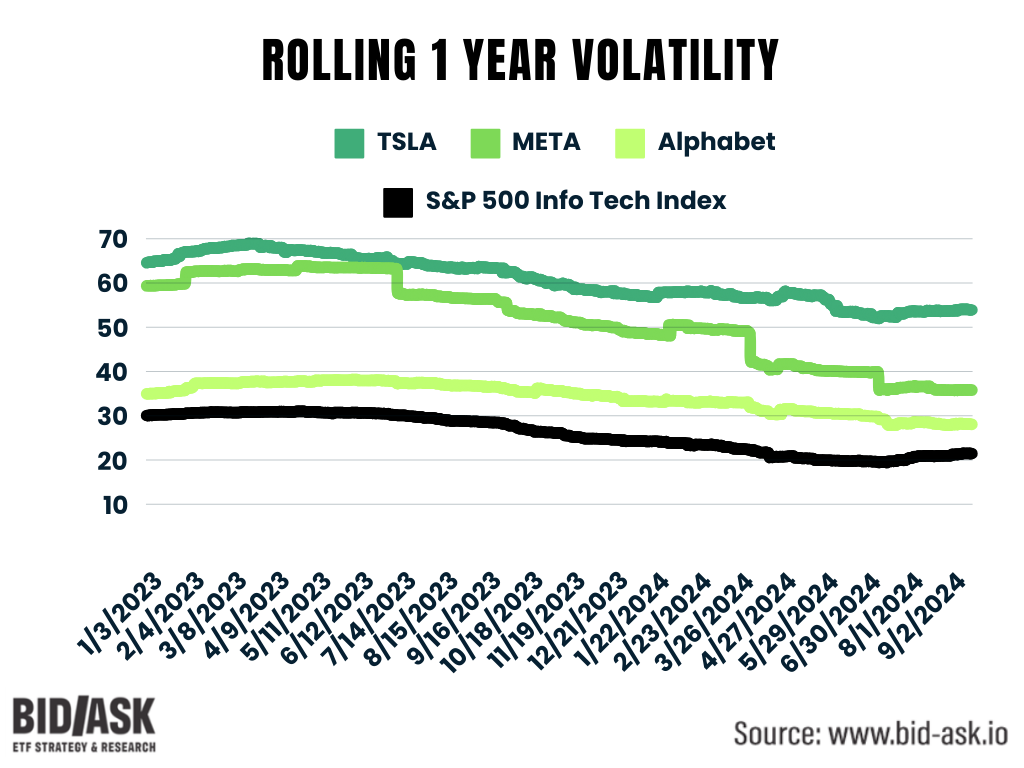

One interesting observation was that the portfolio’s beta was relatively lower in the last 12 months than the previous 2 years. We know the volatility of the entire market has declined in 2024 compared to 2023, but the results tell us the Bid/Ask portfolio’s volatility declined more than the other ETFs on a relative basis.

Perhaps this was due to the significant decline in volatility for Meta which was ~7.5% of the portfolio to start 2024.

Could we be witnessing the early days of a regime shift where Meta, Alphabet and Tesla end up being a significant positive force in an investor’s AI focused tech portfolio?

If so, the $146 billion of assets sitting in tech ETF’s with zero exposure to these three stocks will fall farther and farther behind, hurting investor outcomes in the process.

We plan to periodically update subscribers on the performance of the Bid/Ask portfolio so consider signing up if you’d like to follow along.

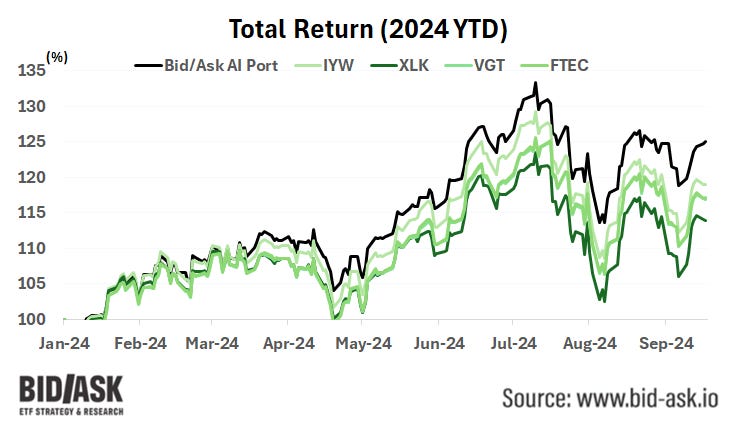

Bid/Ask Portfolio Beating Tech ETFs Significantly Through September 17th (YTD)

There isn’t a technology fund on the market that tracks the S&P 500 information technology index AND owns AI champions Meta, Alphabet and Tesla.

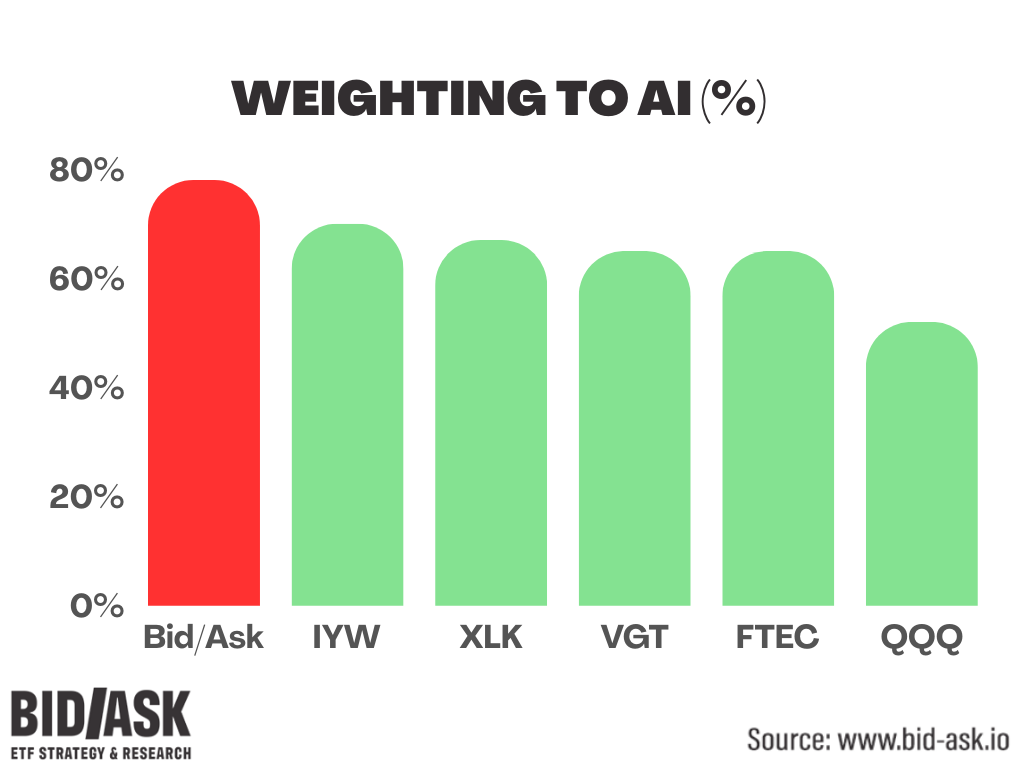

However, you can roughly recreate this exposure by putting 80% of capital in your preferred tech ETF and another ~20% in Meta, Alphabet and Tesla, weighted by market cap. As of September 18th, Alphabet, Meta and Tesla were 11.7%, 7.8% and 0.65% of the Bid/Ask AI Portfolio respectively.

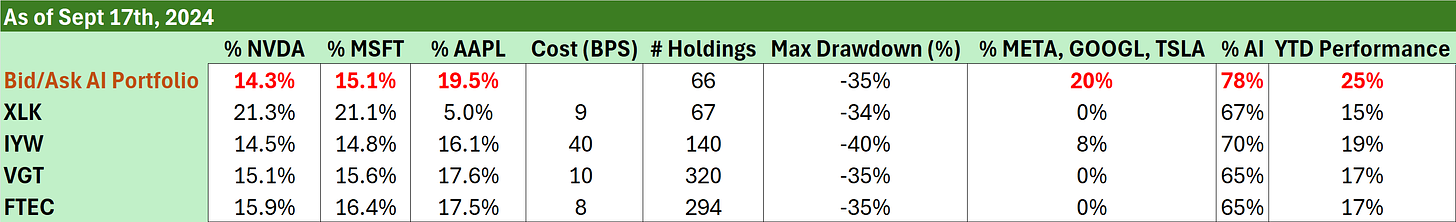

To help you further differentiate between the technology funds available on the market, we’ve provided a detailed table of useful metrics.

Tech ETF Characteristic Table

Coming Up…

Bid/Ask is just getting warmed up. Next episode we are heading to a different sector of the economy, uranium.

Discussing the investment case, very timely with the three mile island announcement, and analyzing the supply and demand outlook as well as the ETF investment options available to investors.

Subscribe to Bid/Ask as we continue to shine a data driven analytical lens on the ETF industry.